More Articles

-

Slick TV ads often make financial planning and wealth management sound simple, but it’s usually not. Managing wealth requires knowing a lot about highly technical topics, like taxes, government regulations, and finance as well as history, psychology and how to communicate with loved ones about sensitive issues. This article highlights some of the knowledge needed to manage wealth and why it’s often so daunting without the help of an independent personal financial advisor who is familiar with your situation.

-

Understanding The Federal Reserve Mandate To End Inflation

The Federal Reserve System, the nation’s central bank, has a dual mandate to pursue maximum employment and maintain price stability. These two priorities are currently treated equally, but that was not always the case. In fact, the Fed’s bias toward maximizing employment was a critical driver of the stagflation that plagued the U.S. in the late 1960s and 1970s. Recognizing the need to balance price stability and maximum employment, in 1977, Congress revised the Federal Reserve Act.

-

Fed Governor Kugler Details Inflation And Economic Outlook

The 12-month inflation rate, as measured by the personal consumption expenditures (PCE) index, was 2.6% in December, down from its peak of 7.1% in June 2022, and the six-month rate for PCE inflation was even lower, at 2%, which is the target rate set by the Federal Reserve.

-

Why Rates May Not Be Cut Until June

The cost of a loan to buy a home, car, college education, and achieve the American Dream is staying the same for now. As expected, Federal Reserve Chairman Jerome Powell said the central bank did not lower loan rates following the Fed’s Wednesday, Jan. 31, 2024, policy meeting.

-

Practical Suggestions For Achieving Your 2024 Resolutions

New Year’s resolutions usually fail because they‘re often too hard to achieve. After six months, only 10% of people who make resolutions achieve them or remain committed to them, , according to a study by Dr. Mark Griffiths, a Chartered Psychologist and Distinguished Professor of Behavioral Addiction at the Nottingham Trent University. What can you do to make financial, medical, or other personal resolutions more likely to be achieved?

-

A Sign Of Progress In Solving U.S. Economic Problems

The Federal Reserve appears to be pulling off a feat most experts did not believe it could: ending its aggressive inflation-fighting campaign of 11 interest rate hikes without tipping the U.S. economy into a recession.

-

Fed Keeps Rates Unchanged; Expects Easing In 2024

To promote transparency and free markets, the Federal Reserve System began publishing the opinions of the 19 U.S. central bankers that decide interest rate policy.

-

Have You Logged Into Your Social Security Account?

Have you logged in to your Social Security account? Creating an online account at SSA.gov is an important first step in understanding your retirement income situation. However, only about 60 million of the 160 million individuals in the U.S. labor force who have Social Security accounts have created a way to access the Social Security Administration’s website.

-

The Great Fake Out Of 2023 Is Poised To Extend Into 2024

All year long, the economy and stock prices have fooled experts and consumers, outperforming expectations month after month.

-

Test Your Financial Planning IQ

The five questions below are a challenge meant to allow you to assess your knowledge of investing, tax and financial planning. If you have been following our news stream, this quiz draws on familiar ground. The answers are below.

- Read More

Planning Briefs

10 Year-End Tips To Slash Your 2022 Tax Bill

Published Tuesday, September 20, 2022 at: 8:30 AM EDT

This is an unusual year-end tax planning season. The pace of federal tax law reform has increased in the four decades and accelerated since the pandemic.

In addition, tax simplification seems like a long-forgotten goal in recent tax reforms. For example, in February 2022, rules implementing the SECURE Act, which was signed into law December 2019, changed a highly technical part of the Internal Revenue Code affecting distributions from federally qualified retirement plans (QRPs) and IRAs, and it will change retirement funding and estate planning decisions for millions of Americans.

Meanwhile, stocks swung up and down this past summer and may stay volatile through the end of 2022, which creates opportunities to realize gains and offset them by taking losses.

To make things simpler, here are 20 reminders about ways to cut your federal tax bill by December 31, 2022. They’re for a broad audience of business owners, doctors, and employees in executive management as well as middle managers, teachers, and other hard-working Americans who are lifelong retirement investors.

1. Have you fully funded your IRA or 401(k) for 2022 to save for retirement and lower your tax bill?

2. If you expect to have a taxable estate in 2026, when the $12.06 million individual estate tax exclusion is slashed to $6.2 million ($12.4 million for married couples), consider making gifts to children and others by December 31.

3. If you expect to have a taxable estate after 2025, consider setting up a trust to transfer assets from your estate to reduce taxes, avoid probate, direct assets to be inherited on terms you specify, and provide your heirs protection from creditors, liens and divorce settlements.

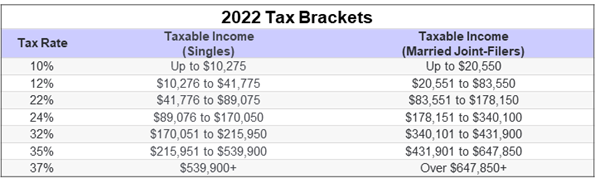

4. If you are edging into a higher tax bracket this year, have you considered ways of bunching charitable donations and other itemized deductions into 2022?

5. If you’re funding college tuition and other qualified education expenses, can you time tuition and other payments to bunch deductions and optimize your itemized deductions in 2022 or 2023?

6. If you own a traditional IRA, is this a good time to consider converting it to a Roth IRA, which could provide tax-free income and other tax benefits to your heirs?

7. If you experienced a financial loss from a property-casualty or theft or paid large property tax or medical bills in 2022, it may be deductible and may make you qualify to itemize deductions.

8. Consider donating appreciated assets to charity, such as publicly traded securities, real estate, or an interest in a private business, to lower capital gains taxes while helping the charity.

9. Have you cleaned out your garage, and other storage spaces to decide what you could give to charity that may have significant fair market value that can be written off against your taxable income with other itemized deductions?

10. If you’re planning to sell your business and have no buyer lined up yet, consider donating some of the proceeds from the sale to a charity to reduce gains taxes.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

©2022 Advisor Products Inc. All Rights Reserved.